Lots of things in your financial adviser business compete of your team’s attention, but which activities and factors are truly “make or break” for your company?

This is where Critical Success Factors (CSFs) become truly important. Amidst all of the bustle and busyness, these are the vital areas of activity which your team need to perform well, in order to achieve your overall business vision and objectives.

This isn’t too say that nothing else matters in your financial planning, apart from your CSFs. Of course, there are many important things to get done. However, if these are focused on to the neglect of your CSFs, then you risk letting your business drift into a dangerous position.

So, what exactly are your CSFs? How do you decide on a list of candidates, and how do you whittle them down to a focused list?

Let’s dive in.

Identifying Critical Success Factors

As mentioned above, there are many activities which could make it onto your list of candidate CSFs. However, the first step is reminding everyone of your overall mission and objectives. After all, these will form the ultimate basis on which you will eventually choose your CSFs.

For instance, here at CreativeAdviser a big part of our mission statement is to become the UK’s primary provider of high-quality, bespoke branding and website design solutions to IFAs. Since this forms a huge part of our raison d’etre, it’s important for us to consider the factors which might affect whether or not we ultimately achieve our ultimate purpose.

For instance, here are some possible CSFs which might naturally flow out of this mission statement:

- On-time project completion;

- Quality of brand and website design for projects;

- Quality of project management (e.g. problem-solving for clients);

- Increased brand awareness amongst IFAs;

- Growth of our IFA client base;

- Achieving a 95% client satisfaction rate;

- Attracting and keeping high-quality staff to deliver the service.

These are just a handful of factors which might affect whether or not we achieve our purpose and corporate objectives. Notice that lots of activities which often keep us busy did not make the list:

- Regular blog posts on our website, to show thought leadership.

- Answering emails and phone calls.

- Keeping information up-to-date in our customer relationship management system (CRM).

- Attending staff meetings.

And so on. This isn’t to say that activities such as these are not important. Indeed, it’s vital that we all turn up for meetings and answer our emails! However, when taken in isolation, activities such as these are only really important if they help to achieve a CSF.

For example, keeping our CRM up-to-date is ultimately important because it helps us achieve a potential critical success factor – namely, growing our IFA client base.

Think about the activities in your own financial planning business. Which ones directly tie into your mission statement? Do you even have a mission statement, enabling you to identify a list of candidate CSFs to choose from?

Narrowing down the list

Given free reign, it would be easy to write a long list of twenty or more CSFs and be left staring at the list feeling overwhelmed, bewildered and no closer to focusing your team on the important activities.

For this reason, it’s really important to narrow your list of CSFs down to a limited number. Keeping the list under a total of five is a good rule of thumb.

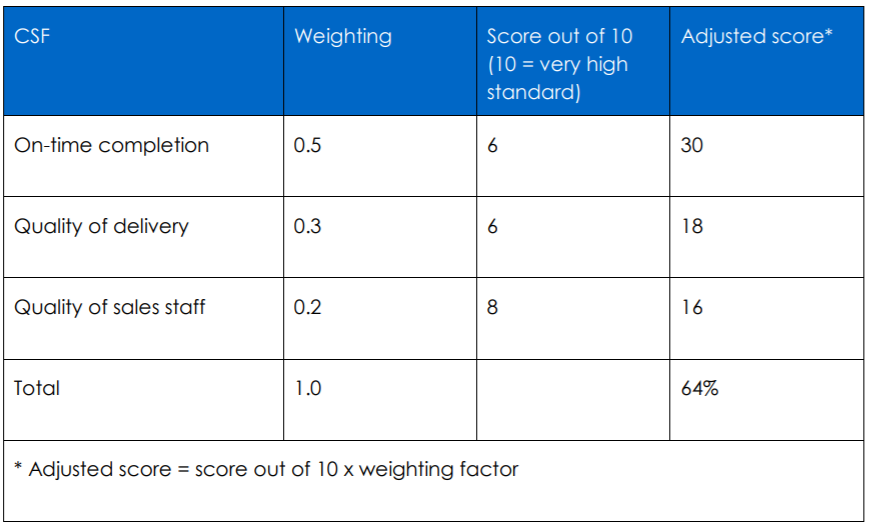

So, let’s assume you have a list of fifteen CSFs – how do you narrow them down? Here, the Cambridge Marketing College provides a very useful table to help you “score” each CSF candidate, to determine which make it into the top five. Here is an example below:

This might look intimidating, but it is fairly straightforward. In each row, you list one of your candidate CSFs. In the second column, you then assign importance to each CSF by through a percentage (note that all of your rows must add up to 100% at the bottom).

From there, you look to the third column to rate your business out of 10 for each candidate CSF. Then, in the final column you record your adjusted score for each row, and then total up everything at the bottom.

Not only does this exercise help you identify which CSFs are most important, and therefore narrow down a large list to less than five. It allows you to determine strong areas and identifies areas of importance where you need to improve in order to secure a competitive advantage.

Indeed, the extra beauty of this approach lies in the fact that you can also use the same scorecard to analyse your nearest competitors and see how you measure up.

Are there any areas where your rivals are performing better than you, and are these significantly important that you should focus on improving?

Final Thoughts

It can be a painful process to identify your CSFs and shift your team’s priorities accordingly. Often, people get used to performing certain tasks or activities, and become attached to them.

Changing their focus onto other things can be uncomfortable and involve a period of readjustment, but is always worthwhile if it results in more attention being paid to your CSFs. Quite often, this adjustment can be managed through clear and careful communication, ensuring that staff are aware that the change in activity and focus are intended to fulfil the ultimate mission, values and objectives of the business – thereby increasing team “buy-in” and bringing them more “on board”.

You might need to bring other stakeholders onto the same page, in a similar way.